|

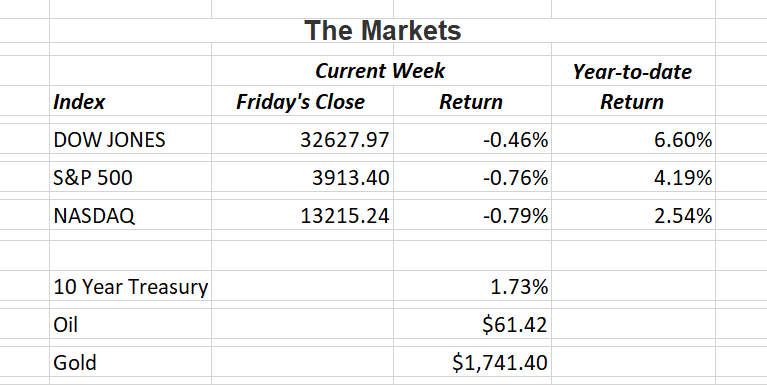

Major U.S. stock indices were slightly lower last week as equities took a pause from the previous weeks strong performance. Inflation continues to be a concern for investors as the yield on the bell-weather 10-year treasury closed at 1.73%. Investors are grappling with an age-old dilemma; economic growth is good…just not too much of it as to cause inflation or a “bubble” in stock prices.

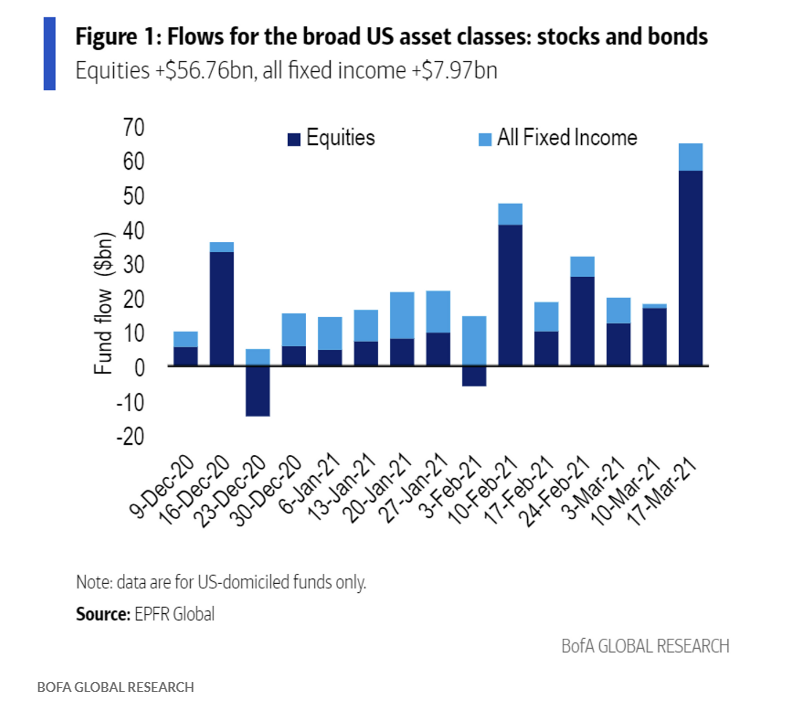

To understand why investor’s are concerned, we examine Bank of America’s Global Research, who on Friday said U.S. equity inflows hit a weekly record of $56.76 billion in the week ending on March 17. That was up sharply from $16.83 billion in the previous week. On March 17, the Dow Jones Industrial Average closed above 33000 for the first time while the S&P 500 finished at an all-time high.

What caused the rise in stock prices? Goldman Sachs estimated that the bigger net inflows into global equity funds coincided with the initial distribution of stimulus checks of up to $1,400 for qualified U.S. citizens. This was part of President Biden’s $1.9 trillion Covid-19 relief package. Through March 17, the U.S. Treasury had distributed $242 billion or about 60% of the expected total.

The chart below shows the sharp spike in inflows into the market. Look at the far right column.

|

|

|

Goldman Sachs goes on to say: “These payments may be making their way into mutual funds and ETF’s, as well as other assets.” All industry categories saw positive net inflows on the week; the largest net purchases were in the telecom and industrial sectors.

We have already seen evidence of U.S. consumers using stimulus funds to pay down debt and build up savings. Now we’re beginning to see them invest the government’s money. How this will affect future stock prices presents a conundrum.

If you have any questions, please contact me.

|

|

The Markets and Economy

|

|

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|